Market Snapshot

Our new Market Snapshot explores the Hang Seng's emissions trends, revealing some interesting emissions figures. Companies representing just ~10% of market value generate about ~80% of total emissions. While China's current energy approach means near-term emissions growth, their renewable investments suggest a significant pivot around 2030, critical insights for investors navigating Asia's climate transition journey.

Our latest Market Snapshot examines emissions trends across Hong Kong’s Hang Seng index. It highlights the paradox of the decarbonisation story in the region.

Key Findings:

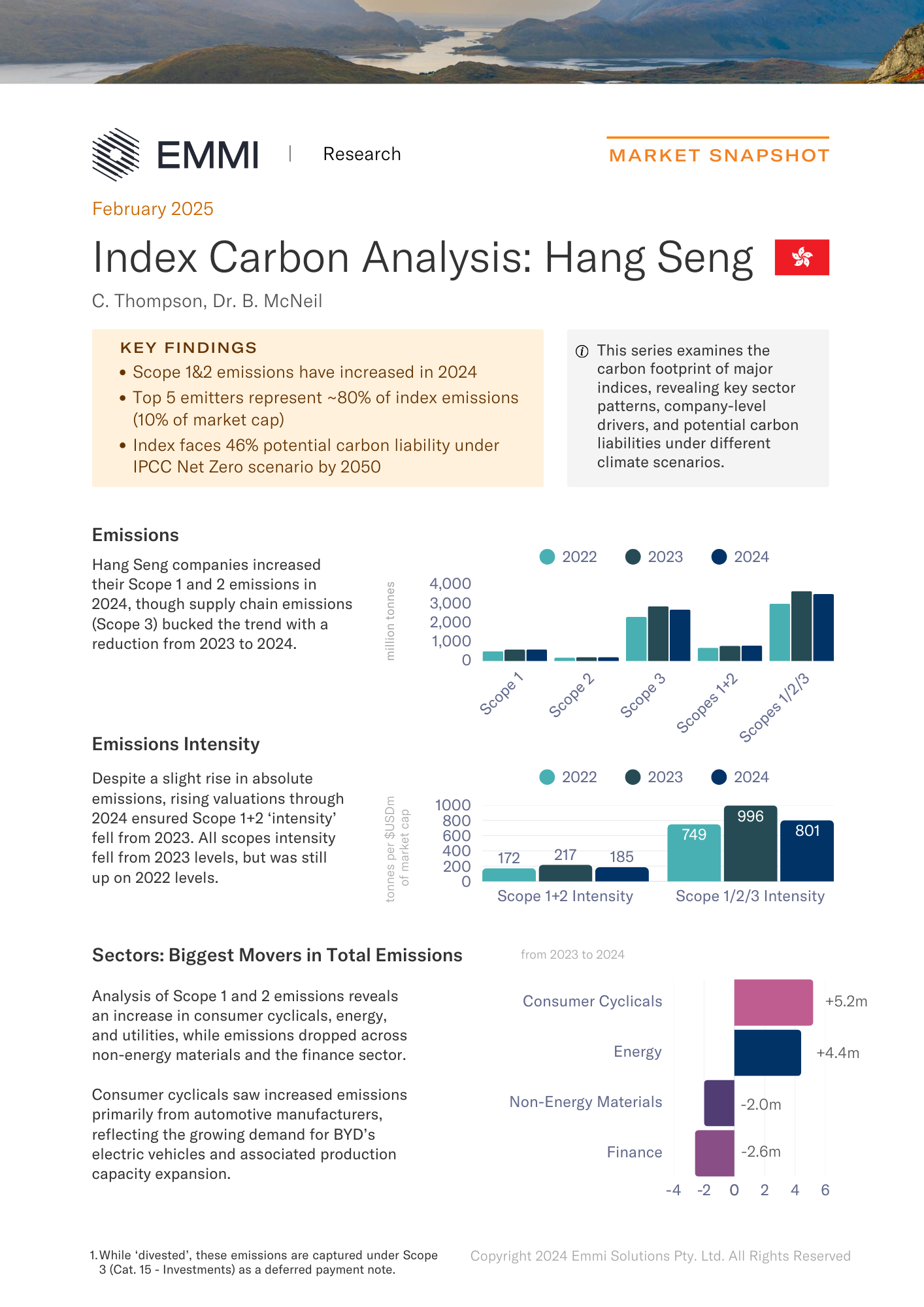

- Scope 1&2 emissions increased in 2024, Scope 3 fell

- Top 5 emitters represent ~80% of index emissions (10% of market cap)

- Index faces 46% potential carbon liability under IPCC Net Zero scenario by 2050

Analysis of Scope 1 and 2 emissions shows that the increased emissions within this index during 2024, were partly driven by growing global demand for BYD’s electric vehicles.

This reflects China’s strategic energy decisions, and is likely to mean emissions increase through to 2030. However, the current weight of investment in renewable generation capacity will likely mean a significant acceleration in the index, and economy as a whole from 2030 to 2050.

Download the full analysis

Stay in the know. Subscribe to updates

Find out about our latest developments, and get our research reports first.